As the effects of the £19.2 million fine continue reverberating across the gaming industry, Williams offers a new perspective on the situation, concluding with a warning to all operators considering investing in the UK. While 888 has agreed to pay up without much hassle and implemented substantial remedial measures, the data implies that William Hill’s disregard for player safety temporarily bolstered customer spending, setting a dangerous precedent.

888’s Commitment to the Purchase Was a Calculated Risk

The UK Gambling Commission (UKGC)’s record-breaking £19.2 million fine was the biggest in the regulator’s history, significantly souring 888’s recent purchase of the offending operator. At one point in the investigation, William Hill even ostensibly risked losing its license to operate in the island nation, potentially making 888’s investment even riskier.

William Hill recognized its failings and worked with the commission to make improvements, but 888’s willingness to proceed with the purchase despite the ongoing investigation raises some questions. Keystone Law regulatory lawyer Richard Williams shared his take on a situation in an interview with gaming news outlet Gambling Insider, breaking down the finer implications.

When 888 acquired the non-US assets of William Hill…, it would have known about the Gambling Commission’s ongoing investigation.

Richard Williams, regulatory lawyer at Keystone Law

Williams argued that 888 was completely aware of the potential fine when closing the £1.95 billion purchase. However, with William Hill’s license potentially on the line, the prospective buyer must have had an unhealthy risk appetite. 888 likely believed that timely reforms and a change in management would be sufficient to appease the UKGC, giving the operator a relatively clean slate when taking over.

The Case Revealed Deep-Seated Issues

According to Williams, 888’s cooperation was the deciding factor behind the UK regulator’s decision to settle for a fine. He noted that the situation had improved significantly since the takeover as the new management finally took the necessary steps to resolve the systemic issues plaguing the UK operator. However, Williams argued that such measures were not without financial consequences.

Implementing rigorous anti-money laundering and social responsibility procedures is likely to slow down customer spending and ultimately reduce revenue for the combined business.

Richard Williams, regulatory lawyer at Keystone Law

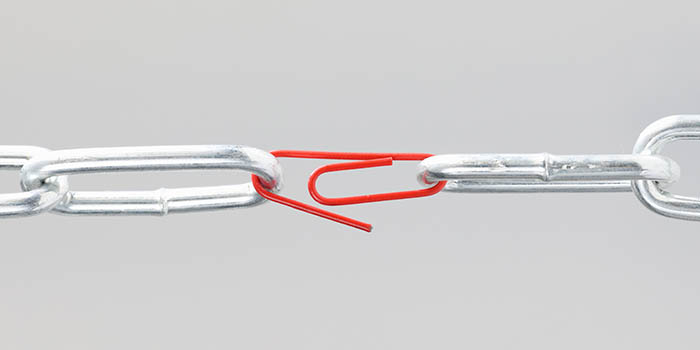

Such statements are dangerous in the context of the wider industry, implying that skirting player safety and AML measures can bolster profits. According to Williams, the entire debacle should alarm everyone looking to invest in UK-facing operators. However, it is also indicative of deep-rooted problems and regulatory impotence.

The £19.2 million fine is just a slap on the wrist for 888, which can earn that back in less than four days. Despite its posturing, the UKGC will likely face a fierce legal battle if it does decide to take the license of a high-profile operator like William Hill. If the regulator continues to shirk its duties, systematic violations will likely continue to be the norm.